Caring for your books so you can run the business you love!

I want to help you run your business as efficiently as you can, by maintaining your financials, so you can concentrate on doing what you do best!

- Anna

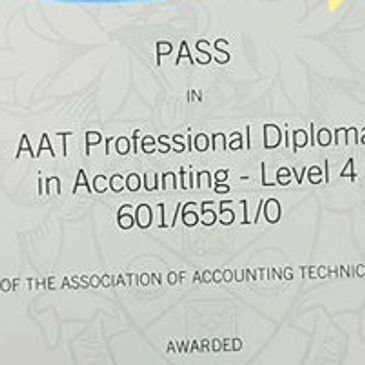

Qualifications and Licenses

About Me

AMD Bookkeeping is run by myself, Anna Duffy.

AMD Bookkeeping is run by myself, Anna Duffy.

AMD Bookkeeping is run by myself, Anna Duffy.

I started my bookkeeping and accountancy journey in 2011.

I am now Level 2, 3 and 4 qualified through AAT (one of the most highly recognised and esteemed qualifications on the market).

This has given me the knowledge to do everything from day to day bookkeeping transactions (invoicing, payroll, bank reconciliations) up to year end statutory accounts for limited companies and their subsidiaries.

I am also xero payroll + advisor certified

Passion for numbers

AMD Bookkeeping is run by myself, Anna Duffy.

AMD Bookkeeping is run by myself, Anna Duffy.

Numbers are certainly not a strong point for everyone. I absolutely love them.

Let me take care of all of your financial needs, so that you can concentrate on running the business you are devoted to. Win for both of us!

Packages

AMD Bookkeeping is run by myself, Anna Duffy.

Packages

My pricing structure is in it's infancy, and as such, i can offer very competitive prices for whatever your bookkeeping necessities happen to be.

Remember, book keepers charge less for the bookkeeping work than an accountant. It makes good financial and practical sense to pay a bookkeeper to get your transactions in order throughout the year, before seeking advice from your accountant.

Small Business Services

Compliance

Compliance

Compliance

- Personal taxation

- VAT

- Advice and reminders of deadlines

- All evidence of income and expenses kept safe guarded for the legally required 6 years

- Tax submission and contacting HMRC on your behalf

Management

Compliance

Compliance

- Bookkeeping: manage daily transactions

- Planning: Reporting and advice to support growth

- Payables & Receivables: Management of supplier and customer invoices

- Timely and accurate reconciliations

Advisory

Compliance

Advisory

- Reporting: Help business owners make informed decisions

- Software comparison and training.

- Making MTD (Making Tax Digital) easy to digest

Menu / Price List

Sole trader

Computation of personal tax for the April tax year (due for payment by the following January 31st)

Bronze package for sole trader

- Self assessment carried out on excel or other spreadsheet software

Silver package for sole trader

- Set up on xero or software of your choice

- Quarterly transactions on accounting software (ie xero)

- Quarterly reconciliations

- VAT returns

Gold package for sole trader

- Set up on xero or software of your choice

- Hub Doc for easy upload of receipts and automated receipt analysis

- Analyse your income and expenses on a monthly basis

- Monthly reconciliations

- VAT returns

- You easily upload your receipts without needing to visit the office

- Communication via xero and hub doc, as well as whats app, phone, and email.

Small to medium business

Bookkeeping, VAT, accounts to trial balance

Bronze package for SMEs

- Monthly bookkeeping transactions

- Bank reconciliations

- VAT Returns

Silver package for SMEs

- Monthly bookkeeping transactions

- Bank reconciliations

- Supplier reconciliations

- Sales invoice reconciliations

- VAT Returns

Gold package for SMEs

- Monthly bookkeeping transactions

- Bank reconciliations

- Supplier reconciliations

- Sales invoice reconciliations

- Monthly or quarterly VAT Returns

- Printed reports

- Financial analysis

- Accounts to trial balance

- Communication with your accountant

Note: An initial meeting, followed by an analysis of the books to calculate the workload, in order to price accurately. I price both according to number of transactions and value added to your business. It is necessary to see the paper work before i can give an accurate quote.

CONTACT

Copyright © 2020 AMD Bookkeeping - All Rights Reserved.